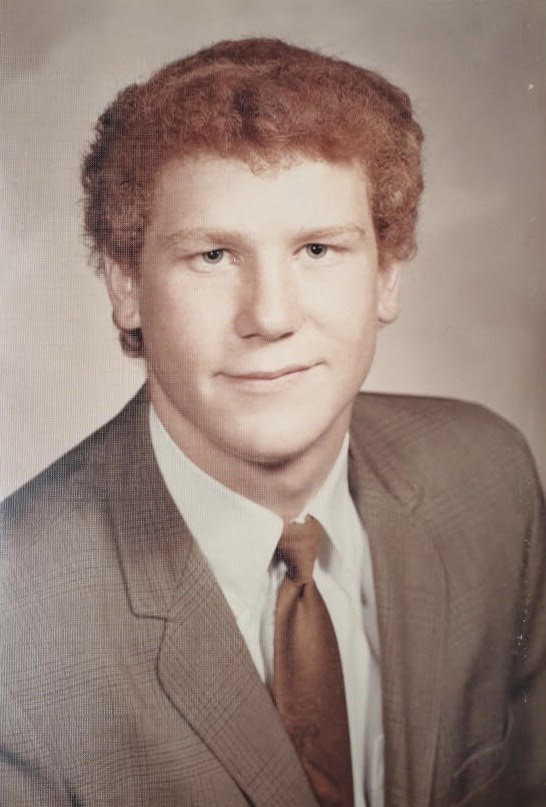

After three generations of service to the banking industry dating back to the Great Depression, the Hoover family has agreed to merge Kaw Valley State Bank with another longtime Kansas business.

Farmers State Bank of Oakley reached out to Bank President Jason Hoover over a year ago looking to expand to the area. The process is now at a point where it has been filed with the FDIC to receive regulatory approval, which can take three to six months, Hoover said.

It’s expected the official switch will happen around Sept. 1, he said.

The decision to merge was not something Hoover was looking for and, before conversations started, he had planned to be at Kaw Valley State Bank the rest of his life, he said.

Hoover said it’s bittersweet for him as he’s been with the bank for 35 of its 126 years.

However, despite the upcoming ownership change, the small-town, community bank feel will stay the same, Hoover said. The Farmers State Bank has been around for about 115 years, so there are a lot of similarities between the two, he said.

Furthermore, for the next five years, Hoover will still be around the bank working as an adviser, so customers shouldn’t notice much change, especially since the staff will remain the same, he said.

“It’s still going to be the same faces, the same smiles, the same people that answer the phone, that take care of them,” Hoover said. “And, you know, there will be some changes, and we’re going to be, once we get a little closer, we’re definitely going to educate everybody on those changes and how it’s going to look and how it’s going to work.”

Hoover said there will be a better experience for customers with improved technology and better products. It’ll be a better bank, which will help the community, he said.

One of the reasons he agreed to do this was after talking with Matthew Engel, president and CEO of The Farmers State Bank of Oakley, and realizing he has the same character and desires for the same type of banking environment.

Engel puts customers and community first, while also taking care of employees and their families, Hoover said. They’re very involved with helping out and staying involved with the community, he said.

“It’s a bank just like ours, just bigger,” Hoover said.

Engel said It’s been a long process to get to this point, so they are looking forward to getting regulatory approval in the coming months.

Expanding operations into eastern Kansas and into the Eudora market seemed like the perfect fit after learning more about Kaw Valley State Bank and meeting with Hoover, he said.

Seeing how they do things and how community-focused they are made for a great fit, Engel said. The bank is a good size and the area’s surrounding communities made it a good place for expansion, he said.

Since Oakley is a city of only around 2,000, Engel said they are familiar with the importance of the small-town banking aspect.

“We love the fact that we know all of our customers, and they come in and we know their names and know their kids and know their family. So we’re excited to get to know the Eudora community that way,” Engel said.

Finding out how instrumental the Hoovers have been in the bank and in the community was a big attraction to coming to the area, he said.

He doesn’t see anything changing for the community or customers’ banking experience. They will have the same employees working every day and helping take care of things, he said. The bank’s name will change to The Farmers State Bank.

“He’s built things very well, and we look forward to continuing everything that he and the Hoovers have done,” Engel said.

He said he was grateful for Hoover’s leadership, support and thoughtfulness about the best course of action for the Eudora community. Hoover did not take this process lightly, which Engel said he respects.

Once the merger is complete, they will have over $375 million in total assets. With the larger scale, there will be more opportunity to enhance services and invest in better technology.

Henry Sloan will take Hoover’s spot at the Eudora location as the regional president. He said he is excited to merge with a bank that has similar values in the same kind of culture they’ve built in Oakley. Keeping the community bank mindset while being engaged with the residents is important to them, he said.

Sloan and his family have moved to the area and are looking forward to meeting people and getting to know customers, he said.

“My family and I are just very excited to be back in the area,” he said. “We’re just very excited to get the deal closed and officially get into the office and get to work with the team there.”